As many of you know that Fibonacci Lines are some type of resistance and support levels, which help us to predict where the market possibly move.

We know that the market moves up and down most of the time and usually after one big move there will be a correction and Fibonacci lines can help us to predict where the correction might end. But you still need to remember that Fibonacci levels do not guarantee anything so you are not suppose to trust it 100%.

Let see how we can work or let say I work with Fibonacci Levels:

1. How to draw Fibonacci Lines

Let see, if we had for example a good downtrend and noticing the market starting to slow down at the end and begging to correct itself, then we would draw Fibonacci Retracement from the low of a candle to the high of the candle (I use the ends of the bodies of the candles).

if it’s uptrend than we draw it the other way around from the high of a candle to the low of the candle.

2. Most Important Fibonacci Levels

Fibonacci Retracement levels – you can see them all on the picture below, during trading and in different situations each level could be important but usually the most important are 50% and 61.8%, though 38.2% and 78% also need to pay attention on.

Fibonacci extension – if the trend continues after a correction or an attempt for correction than the most important extension levels are – 138,2% and 161.8%, also – 118% and 127%.

3. Main factors to consider

Trading with Fibonacci lines more effectively you need to consider some other factors:

- 1. you need to identify the trend;

- 2. you need to check the situation on the market in total to understand what is happening with it, for example check the monthly chart and analyze what was happening for the last months and years;

- 3. you need to use some other support and resistance lines (identify the channels, triangles…);

- 4. very important – Main Economical events and news

4. The ways to trade Fibonacci Levels

One of the most common way is to buy or sell after correction around levels 50% – 61,8 %, and then follow the trend using Fibo Lines to close the position.

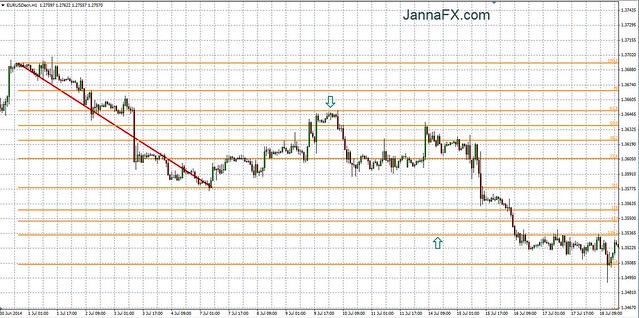

Here is one good example – EUR/USD, 1H chart, we had a downtrend, drawn Fibo lines, market correction reached level 61,8% – we would SELL here. After that we would watch the market, predicting it continuing the downtrend.

Some traders would usually watch the market without placing the Stop Loss and Take Profit, some would place the Stop Loss slightly above the level 100% and Take Profit around 138,2% or 161.8%. The best way is to watch the market, analyze the situation and move Stop Loss every time the market moves down.

The most important level 0.0%, usually if the market would brake it it would mean that the trend will continue, if not it would mean that the market changing the trend. In our example the market broke that level and reached 161.8% and went lower.

So we could walk away with the profit around 100 pips, or we could continue follow the downtrend, or we could close some positions around different levels, it would depend on your style of trading.

Another way to trade Fibonacci levels – when the correction finished and market continue its trend and brakes the level 0.0%.

In our example market correction was finished at the level 61.8%, but we did not sell and decided to wait for the market continue the downtrend. The market was moving in the middle for a while and finally broke the level 0.0%.

Here we would need a bit more confirmation, in this example the market formed the channel, so we could draw it and use the system which I use – 20 pips up from it and 20 pips down – Sell. After that as usual we would follow the trend changing the stops and closing some positions.

If there is no good channel, like in our next example, then you could look for 2 good full candles. Here we have an uptrend and the small correction finished and market trying to brake the level 0.0%, but we have to wait for one nice green candle to cross that level and then we would wait for the second nice green candle which should be bigger then the first candle and higher.

Here we had 3 attempts of braking the level – in first, which failed – it was a good candle which crossed the line, but next candle was red, then small green, red again; second attempt also failed – there were 2 green candles which touched the level with the ends of their bodies, then red candle, small green, red; finally the third attempt was successful – good green candle crossed the level, after that there was green but very small candle so we waited for the next good green candle, which closed higher and it was a signal to Buy.

After that we would follow the trend as usual, changing Stop Loss, closing some or all positions at level 161.8%. And if we are looking for downtrend then the candles will be red and the second will be lower then the one which must cross the level.

If you use these two ways of trading Fibonacci Levels you would need few days, what I mean is – it could take you few days to find the entry for trade or you could be in the trade for few days.

So now, how I use Fibonacci Lines in my day trading – I do not use Fibo lines to enter the market I always draw the channel as you know and use Fibo to exit the trade not just with my 10 pips but bigger profit, if I can watch the market I would follow the trend and change the stop, if I can’t watch the market I would place the orders to Take Profit for 10 pips as usual and additionally around important Fibonacci Levels.

For best results it’s always better to watch the market around 06:00am – 16:00pm GMT (or London +-1h) or later if there are news. Or you can place the alarms around important levels, so you can control the situation and analyze the market.

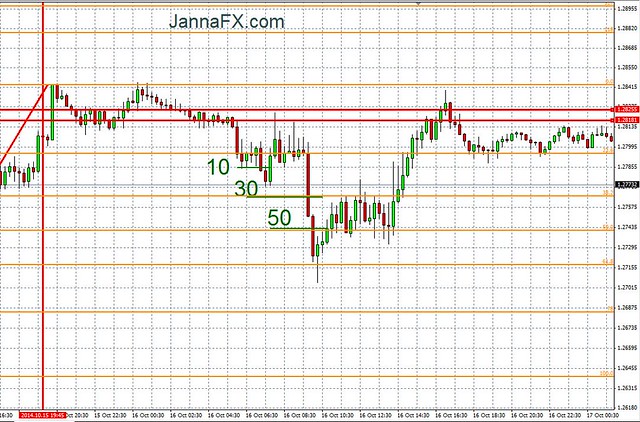

Here is an example of my trade, I draw the channel as usual, I identified the uptrend and it’s correction, but I could not watch the market all day, so I draw Fibonacci Retracement instead of extension for the uptrend. I thought, yes it would go up, but what if it will turn, correct that small downtrend and continue go down, so I would better take profit around level 61.8%, it’s safer than go for the higher level.

So I did, I walked away with my usual 10 pips profit + 40 pips thanks to Fibonacci. But if I would watch the market that day I would not place orders to take profit at 61.8%, I would follow the trend and walk away with at least 80 pips, or, there were news that day and if it would be possible when the market started to move fast high to close positions at 150 – 200 pips profit

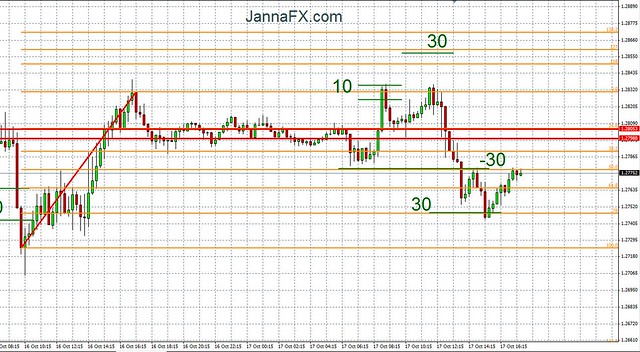

Another example, channel as usual and Fibonacci retracement, predicting the end of uptrend correction around level 61.8%, but to be safe I chose level 38%, because it was quiet day with some but not major news for EUR/USD. I walked away with my 10 pips + 30 pips profit. If I would watch the market my profit would be 10 + 50 pips.

And last very good example of trades to possibly avoid. As usual I draw the channel and Fibonacci Retracement to predict the end of uptrend correction.

First of all the channel was bad, and it’s better to avoid channels like this one, it was hard to draw the top line, I chose the level 23%. The uptrend was a bit small should of been higher then the previous uptrend but it stopped.

So I was hoping that it should continue go up and brake level 0.0% but if it would go down I thought it would reach level 61.8% which was only around 20 pips away from the channel, too low should not go for trades like that.

But I risked it and placed my orders as usual 10 pips profit and 30 pips using Fibo lines up and down. As I did not watch the market, the result was – I made my usual 10 pips profit, but with Fibo lines I lost 30 and made 30 back.

So ones more, for best results watch the market, if you can’t – don’t go for risky trades.

If I would watch the market that day I would close my loosing trade at break even or with minimum loss after the market tried to brake level 0.0% second time unsuccessfully and walked away with 10 – 40 pips profit.

Finally, Fibonacci Lines could be used on any pair and time frame, I usually use Monthly, 1H, 30m and 15M time frames.

Here are Fibonacci levels if you don’t have them all you can add them in Fibonacci Retracement – Fibo Properties.

0 – 0

0.236 – 23.6

0.382 – 38.2

0.5 – 50.0

0.618 – 61.8

0.78 – 78

1 – 100

-0.18 – 118

-0.27 – 127

-0.382 – 138.2

-0.618 – 161.8

-1 – 200

-1.618 – 261.8

Sorry for my English, if you did not understand something, pl ask questions, I’ll try to respond ASAP. 🙂

READ MORE FOREX ARTICLES:

- Forex Robot JannaFX LineTrader

- $2500+ Profit this Week Trading, XAUUSD Analysis 9th – 14th April 2023

- $90000 Profit in October Trading GOLD, Forecast 05th – 10th November 2023

- My Gold trading results in 3 months and technical analysis for the 4th – 9th June 2023!

- $30000 Profit in February 2023, Gold Trading

- Gold Trading, XAUUSD Analysis, My Trades and Profit 23 – 27 Jan 2023

- How Much I Made Trading Gold in December 2022 and January 2023 First Week

- How Much I Earned Trading Gold on 12th – 16th December 2022

- How Much I Made in November’22 Trading Gold

- How Much I Earned Trading Gold on 14th – 18th November 2022

- My trading results 7th – 11th November 2022

- My trading results 23d – 28th October 2022.

- My trading results this week 17th – 21st October 2022.

- Forex Forecast 16th – 21st October 2022 and Trading Results for This Week

- My Trading Results in 2022

- Forex Forecast, Main Pairs, Gold, Oil, Bitcoin May 2022

- Forex Forecast, Main Pairs, Gold, Oil, Bitcoin 21st – 25th February 2022

- All you need to know about the workplace of a trader!

- Getting ready for the Santa Claus Rally

- Forex Forecast, Main Pairs, Gold, Oil, Bitcoin Analysis, December 2021 – February 2022

- My Forex Trading Week 1st – 5th November 2021, Trades

- Forex Forecast, Bitcoin Price Prediction, 11th – 15th October 2021

- Forex Forecast, Bitcoin Price Prediction, 20th – 24th September 2021

- Weekly Forex Forecast, Bitcoin Price Prediction, 12th – 17th September 2021!

- Forex Forecast, Bitcoin Price Prediction, 16th – 20th August 2021

- Forex Forecast, Bitcoin Price Prediction, 9th – 13th August 2021

- Forex Forecast, Bitcoin Price Prediction, 26th – 30th July 2021

- Forex Forecast, Bitcoin Price Prediction, 19th – 23d July 2021

- Forex Forecast, Bitcoin Price Prediction, 12th -16th July 2021

- My June Trading Performance, Forex and Bitcoin Analysis, 5th – 9th July 2021

- Forex Forecast, Bitcoin Price Prediction, 21st -25th June 2021

- Forex Forecast, Bitcoin Price Prediction, 13th -18th June 2021

- Forex Forecast, Bitcoin Price Prediction, 6th -11th June 2021

- Forex Forecast, Bitcoin Price Prediction, 31st May – 4th June 2021

- Weekly Forex Analysis, 25th – 30th April 2021, My Trading Plan

- Weekly Forex Analysis, 12th – 16th April 2021, My Trading Plan

- Weekly Forex Analysis, 28th March – 2d April 2021, My Trading Plan

- Weekly Forex Analysis, 22d – 26th March 2021, My Trading Plan

- Weekly Forex Analysis, 15th – 19th March 2021, My Trading Plan

- Weekly Forex Analysis, 8th – 12th March 2021, My Trading Plan

- YieldNodes Audit, February 2021

- Forex Signals for a Week – Profit in Every Trade!

- Forex Market Review 15th February 2021

- Weekly Forex Analysis, 15th – 19th February 2021, My Trading Plan

- Weekly Forex Analysis, 01 – 05 February 2021, My Trading Plan

- Weekly Forex Analysis, 24th – 29th January 2021, My Trading Plan

- Forex Brokers with Deposit Bonus

- Weekly Forex Analysis, 18th – 22d January 2021, My Trading Plan

- Weekly Forex Analysis, 10th -15th January 2021, My Trading Plan

- Weekly Forex Analysis, 14th -18th December 2020, My Trading Plan

- Weekly Forex Analysis, 16th -20th November 2020, My Trading Plan

- Weekly Forex Analysis, 9th -13th November 2020, My Trading Plan

- Weekly Forex Analysis, 2d-6th November 2020, My Trading Plan

- Weekly Forex Analysis, 26th -30th October 2020, My Trading Plan

- Weekly Forex Analysis, 19th -23d October 2020, My Trading Plan

- Weekly Forex Analysis, 7th -11th September 2020, My Trading Plan

- Trading GOLD with EA, REAL ACCOUNT, August 2020 Result

- Weekly Forex Analysis, 31st August – 4th September 2020, My Trading Plan

- New Passive Income Opportunity With Cryptocurrencies

- Trading GOLD with EA, REAL ACCOUNT, 19th August 2020

- Trading GOLD with EA, REAL ACCOUNT, 18th August 2020

- Trading GOLD with EA, REAL ACCOUNT, 17th August 2020

- Trading GOLD with EA, REAL ACCOUNT, July 2020 Result

- My Part Time Forex Trading Results for June 2020

- GOLD Trading with Robot, Results in June 2020

- Weekly Forex Analysis, 29th June -3d July 2020, My Trading Plan

- Weekly Forex Analysis, 22d – 26th June 2020, My Trading Plan

- Weekly Forex Analysis, 15th – 19th June 2020, My Trading Plan

- Weekly Forex Analysis, 8th – 12th June 2020, My Trading Plan

- Weekly Forex Analysis, 1st – 5th June 2020, My Trading Plan

- Weekly Forex Analysis, 25th – 29th May 2020, My Trading Plan

- Gold Trading, with JannaFX LineTrader EA

- Weekly Forex Analysis, 17th – 22d May 2020, Where I Look to Buy/Sell

- My Forex Trading Results for 1 Year

- Forex Day Trading, How I Trade Every Day!

- Weekly Forex Analysis, 10th – 15th May 2020, Where I Look to Buy/Sell

- My Forex Trading Results from Last Week in April

- A TIME TO BUY

- Weekly Forex Analysis, 3d – 8th May 2020, Where I Look to Buy/Sell

- Weekly Forex Analysis, 26th April – 1st May 2020, and Last Week Trades Results

- Forex Trading, EURUSD Trading Manually vs Auto, LineTrader EA

- Weekly Forex Analysis, 20th – 24th April 2020, Where I Look to Buy/Sell

- Forex Trading, My Trades Explained, 12th -17th April 2020

- Forex Trading Results and Forecast 12th-17th April 2020

- Today’s Trades Explained, 6th April 2020

- Weekly Forex Analysis, 6th – 10th April 2020, Where I Look to Buy/Sell

- Forex Trading on Friday 03d of March, Examples of My Trades

- 2 Days of Forex Trading, Examples of My Trades

- How To Backtest in MT4, FOREX Robots and Indicators, Strategy Tester

- My Weekly Forex Technical Analysis, 22d – 27th March 2020, Bitcoin, Crude Oil

- My FOREX TRADING Week, That’s How YOU COULD TRADE!

- My Weekly Forex Technical Analysis, 8th – 14th March 2020, My Screenshots

- Weekly Forex Analysis, 1st – 6th March 2020, Where I Look For New Orders

- My Weekly Forex Technical Analysis, 9th – 14th February 2020, My Screenshots

- My Weekly Forex Technical Analysis, 2d – 7th February 2020, My Screenshots

- My Weekly Forex Technical Analysis, 26th – 31st January 2020, My Screenshots

- My Weekly Forex Technical Analysis, 12th – 17th January 2020, My Screenshots

- How To Trade a GAP

- Selecting the Best Forex Team for You

- My Weekly Forex Technical Analysis, 6th – 10th January 2020

- My Weekly Forex Technical Analysis, 29th December 2019 – 3d January 2020

- My Weekly Forex Technical Analysis, 23d – 27th December 2019, My Screenshots

- My Weekly Forex Technical Analysis, 16th – 20th December 2019, My Screenshots

- My Weekly Forex Technical Analysis, 9th – 13th December 2019, My Screenshots

- How My Forex Technical Analysis Works, Results 2

- HOW I TRADE FOREX, With PRICE ACTION, Real Trades

- My Weekly Forex Technical Analysis, 2d – 6th December 2019, My Screenshots

- Happy Thanksgiving Day to all my friends in USA!

- Weekly Forex Technical Analysis, 25th – 29th November 2019, My Setups

- Weekly Forex Technical Analysis, 16th – 22d November 2019, My Screenshots

- Weekly Forex Technical Analysis, 11th – 15th November 2019, My Screenshots

- How My Forex Technical Analysis Works, Results 1

- Weekly Forex Analysis 4th – 8th November 2019

- My Weekly Forex Analysis 7th – 11th October 2019.

- Forex Trading, GBP Pairs Entry Points With My Screenshots

- My Weekly Forex Analysis 23d – 27th September 2019.

- My Weekly Forex Analysis 16th – 20th September 2019.

- My Weekly Forex Analysis 9th – 13th September 2019

- My Weekly Forex Analysis 2d – 6th September 2019.

- 2000+ pips PROFIT in AUGUST, PART-TIME FOREX TRADING

- My Weekly Forex Analysis 26th – 30th August.

- My Weekly Analysis 19th – 23d August and Screenshots.

- Weekly Forex Analysis, 12th- 16th August 2019, Entry Points, Main Pairs, GOLD

- Weekly Forex Analysis, 22d- 26th July 2019, Entry Points, Main Pairs, GOLD

- Forex Trading News, +130pips Trading NFP, with My Easy Strategy

- Forex Trading Results in June 2019 and My Weekly Forecast 1st-5th July 2019

- Weekly Forex Analysis, 24th – 28th June 2019, Entry Points, Main Pairs, GOLD

- Forex Trading, Live Small Account +130pips, My Successful Entry Points This week!

- Weekly Forex Analysis, 10th- 14th June 2019, Entry Points, Main Pairs, Gold

- Forex EA – Line Trader Instructions

- Trading Week Results and My Weekly Forex Analysis, 3d-7th June 2019

- Weekly Forex Analysis, 27th- 31st May 2019, Entry Points, Main Pairs, Gold

- Weekly Forex Analysis, 20th- 24th May 2019, Entry Points, Main Pairs, Gold

- My Forex Trading Ideas On 17th May 2019, Possible Entry Points

- My Forex Trading Ideas On 16th May 2019, Possible Entry Points

- My Forex Trading Ideas On 15th May 2019, Possible Entry Points

- My Forex Trading Ideas On 14th May 2019, Possible Entry Points

- Weekly Forex Analysis, 13th- 17th May 2019, Entry Points, Main Pairs, Gold

- My Forex Trading Ideas On 10th May 2019, Possible Entry Points

- My Forex Trading Ideas On 9th May 2019, Possible Entry Points

- My Forex Trading Ideas For 8th May 2019, Entry Points

- My Forex Trading Ideas For 7th May 2019, Entry Points

- Weekly Forex Analysis, 6th- 10th May 2019, Entry Points, Main Pairs, Gold

- Forex Trading Competition Results, The Winners!

- My Forex Trading Ideas For 3d May 2019, Entry Points

- My Forex Trading Ideas For 2d May 2019, Entry Points

- My Forex Analysis For 1st May 2019

- Forex Trading With Stop Loss, Where to Place and How To Recover the Loss

- Weekly Forex Analysis, 29th April – 3d May 2019, Entry Points, Main Pairs, Gold

- Cryptoxygen tokens going live on SistemKoin!

- Weekly Forex Analysis, 22d – 26th April 2019, Entry Points, Main Pairs, Gold

- Forex Trading Competition! List of Competitors.

- Forex Trading Competition With Real Cash Prizes!

- Weekly Forex Analysis, 8th – 12th April 2019, How To Read My Daily Screenshots, Entry Points!

- Weekly Forex Analysis, 1st – 5th April 2019

- Weekly Forex Analysis, 18th – 22d March 2019, Entry Points, Main Pairs, Gold

- Weekly Forex Analysis, 11th – 15th March 2019, Entry Points, Main Pairs, Gold

- Weekly Forex Analysis, 4th – 8th March 2019, Entry Points, Main Pairs, Gold

- Weekly Forex Analysis, 25th February – 1 March 2019, Entry Points, Main Pairs, Gold

- Weekly Forex Analysis,18th – 22d February 2019, Main Pairs, Gold

- Weekly Forex Analysis,11th – 15th February 2019, Main Pairs, Gold

- Weekly Forex Analysis, 4th – 8th February 2019, Main Pairs, Gold

- Forex News Trading, How I Trade News, Real Time Example, Manual Trading

- Weekly Forex Analysis, 28th January – 1st February 2019, Main Pairs, Gold

- Weekly Forex Analysis, 21st – 25th January 2019, Main Pairs, Gold

- My SUCCESSFUL FOREX STRATEGY Update, 200% Profit Part Time Trading in a Year

- Weekly Forex Analysis, 14th – 18th January 2019, Main Pairs, Gold

- Fibonacci Lines

- Weekly Forex Analysis, 7th – 11th January 2019, Main Pairs, Gold

- What is Pip and Leverage in Forex?

- HAPPY NEW YEAR 2019!

- NO LOSS FOREX STRATEGY, LIVE TRADING, $2000 Profit on Christmas Week

- Forex Trading During Holiday Season, My Results

- Merry Christmas!

- FOREX STRATEGY: No Signals, No Indicators System

- Weekly Forex Analysis 24th – 28th December 2018

- Top 3 Forex Brokers

- News Trading Strategy in Forex

- FOREX BASICS

- What is FOREX?

- WEEKLY FOREX ANALYSIS, 17th – 21st December 2018