By Joe Cotton, Publisher “Cotton’s Technically Speaking”.

March 21, 2020

The Market has crashed, dropping about 10,000 points in less than 30 days, aided and abetted by overvalued share prices and the Coronavirus, Covid-19. See attached chart.

Typically there are 2 types of Bear Markets- either A) a long extended decline with 3 down-legs, punctuated by significant rallies after each down-leg, or B) a violent down-move of short duration.

In our March 2nd Market Letter we said that we believed that the previous week’s record 4,000 point down- move was the 1st down leg of a new Bear Market.

We now believe that the Bear Market has probably ended, judging from the already hellacious 50-75% declines in so many stocks…many of which have started to rebound.

We think Facebook (FB) 149.73, with a P.E.Ratio of only 16.59, based on estimated 2020 earnings, and Alphabet (GOOG) 1072.32 with an estimated 20.09 P.E. Ratio, are good bargains. But to be prudent, we would only put in 50% of our cash now, and keep 50% in reserve-in order to buy again if Facebook were to drop another 50 points or if Google dropped another 450 points…which is still possible, but not probable.

Bargains Abound !!

I advised my wife, whom complains about the puny interest she receives on her PNC Money market account, to take some of her money and buy the following stocks in order to increase her monthly income. Keep in mind that she probably won’t do what I suggest because she hates the stock market and says it’s just a big casino, where you can lose all of your money.

A little over 4 years ago, I tried to get her to buy 1,000 shares of Walmart which was selling for $55 a share and had a 3.5% Dividend, which would have given her a pro rata earnings of $160.41 per month. But she demurred. Walmart closed Friday at 113.97, so she would have doubled her money in only 41/2 years….not bad.

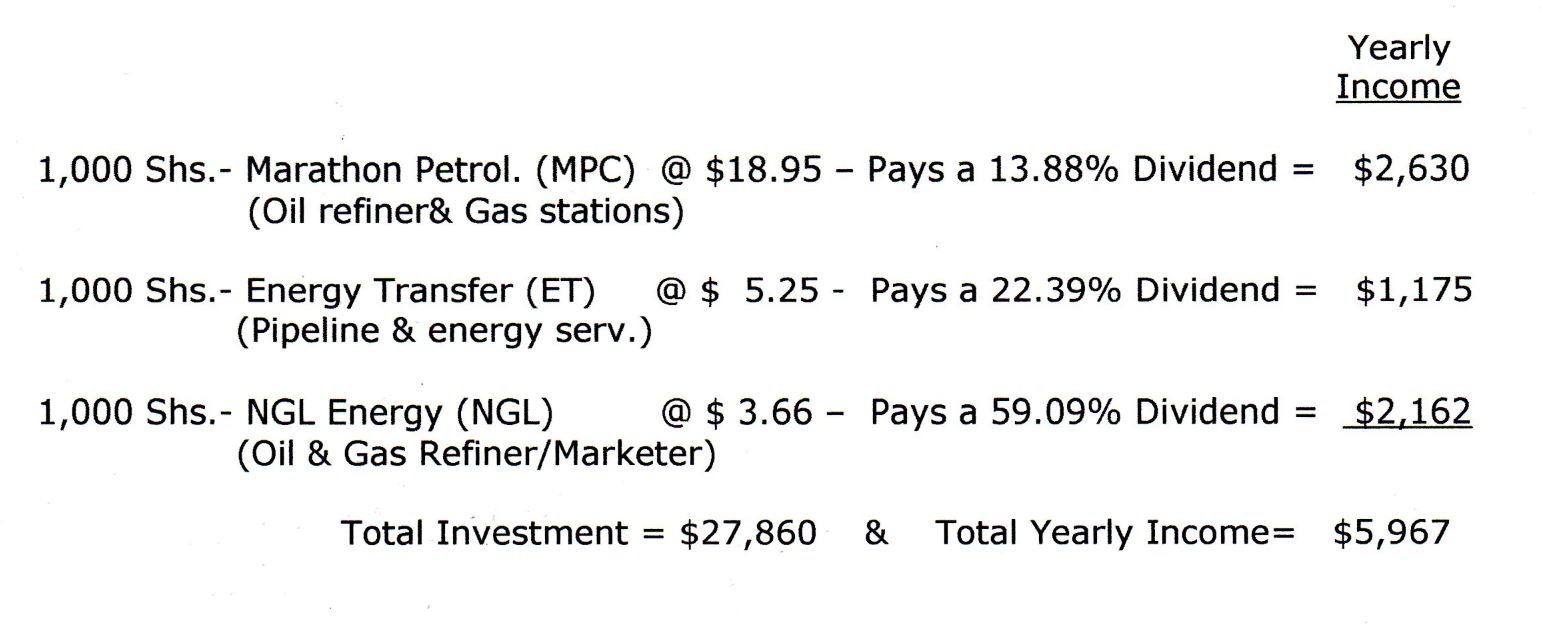

Today I advised her to buy the following stocks in order to give her some additional monthly income:

So, for an investment of $27,860, my wife could have a yearly income of $5,967 (or $497.25 per month) which is equal to a 21.41% return. Keep in mind that there is substantial risk in this market, but it sure beats the $278.60 yearly return ($23.21 per month) that she would be lucky to get at the bank.

Needless to say, my wife again demurred. However, I will be Buying MPC, ET and NGL on Monday, March 23, 2020.

NOTE: This article is not investment advice, nor is it in any way to be construed as investment advice. For Investment Advice consult a Registered Investment Advisor or a Certified Financial Planner. Joe Cotton’s website is www.cottonstocks.net

This article was published in the Northern Kentucky Tribune on March 24, 2020. To view it go to nkytribune.com. At the website, click on Business at the top of the page and then scroll down by date to view the article.